IRS Approves $2,000 Direct Deposit for January 2026: Key Details for Taxpayers

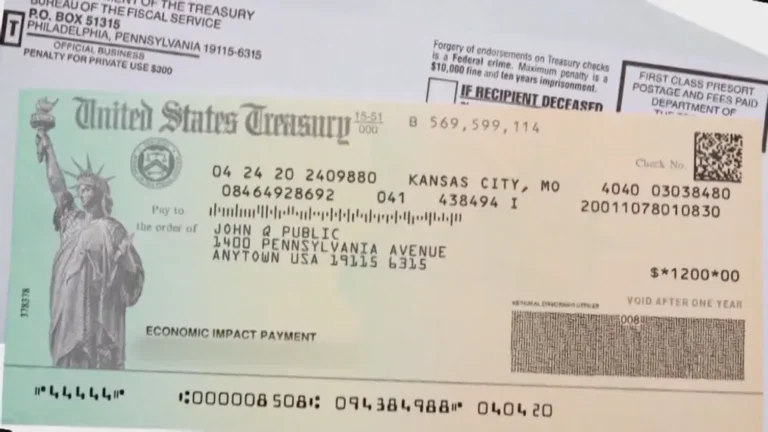

As the new year begins, many Americans are looking for financial relief to offset rising living costs. According to the latest updates, the Internal Revenue Service has approved a $2,000 direct deposit payment scheduled for January 2026, offering eligible taxpayers a welcome boost at the start of the year.

The payment is designed to provide short-term financial support and will be issued automatically to qualifying individuals based on existing IRS records.

What Is the $2,000 IRS Direct Deposit?

The $2,000 payment is a one-time direct deposit authorized for distribution in January 2026. Unlike a standard tax refund, this payment is not dependent on filing a new return for 2026 and is expected to be processed separately from regular tax-season refunds.

For many households, the funds may help cover essential expenses such as housing costs, utilities, groceries, medical bills, or other early-year financial obligations.

Who May Be Eligible

Eligibility is expected to be based on income limits, filing status, and recent tax records already on file with the IRS. In general:

-

Individuals and families with low to moderate incomes are most likely to qualify

-

Taxpayers who filed recent federal tax returns are prioritized

-

Direct deposit recipients will receive funds faster than those waiting for mailed payments

Income thresholds and payment reductions may apply for higher earners.

When Will the Money Arrive?

The IRS plans to begin sending payments in early January 2026. Most eligible recipients with direct deposit information on file should receive their payment within the first half of the month.

Those without banking details registered with the IRS may receive the payment by alternative methods, which could take additional time.

Do Taxpayers Need to Apply?

For most eligible individuals, no application is required. The IRS will use existing tax data to determine eligibility and issue the payment automatically.

However, taxpayers who recently changed bank accounts, moved, or updated personal information are encouraged to ensure their IRS records are accurate to prevent delays.

Why This Payment Matters

A $2,000 direct deposit can make a meaningful difference for households entering the new year. Financial experts note that early-year relief payments can help families:

-

Recover from holiday spending

-

Manage ongoing inflation pressures

-

Reduce reliance on credit or short-term loans

For those living on fixed or limited incomes, the payment may provide important breathing room during a financially demanding time of year.

What to Do Now

To avoid delays, taxpayers should:

-

Review their most recent tax return for accuracy

-

Confirm that direct deposit details are correct

-

Monitor official IRS updates regarding payment timing

Keeping records current increases the likelihood of receiving the payment smoothly and on time.

The IRS-approved $2,000 direct deposit for January 2026 is a one-time relief payment aimed at helping eligible Americans start the year with additional financial support. While not a recurring benefit, the payment offers short-term assistance that could ease budget pressures for millions of households.

As January approaches, taxpayers are encouraged to stay informed and prepared to ensure they receive the full benefit of this payment without delays.

Pulkeet Gupta is a dedicated content writer specializing in the field of education and entertainment niche. With a passion for learning and a keen interest in sharing knowledge, Pulkeet has established himself as a prominent figure in the education and entertainment writing community.